All Categories

Featured

There is no one-size-fits-all when it comes to life insurance policy./ wp-end-tag > In your busy life, monetary self-reliance can seem like an impossible goal.

Fewer employers are providing traditional pension plans and many business have actually decreased or ceased their retired life plans and your capacity to depend entirely on social safety and security is in question. Also if advantages have not been minimized by the time you retire, social safety alone was never intended to be sufficient to pay for the way of living you want and are entitled to.

/ wp-end-tag > As component of a sound economic technique, an indexed global life insurance plan can aid

you take on whatever the future brings. Prior to committing to indexed universal life insurance policy, here are some pros and cons to consider. If you pick a great indexed universal life insurance policy plan, you may see your money worth expand in value.

Equity Indexed Life Insurance Definition

Given that indexed global life insurance policy calls for a particular level of threat, insurance coverage firms often tend to maintain 6. This type of plan likewise supplies.

Usually, the insurance policy business has a vested interest in carrying out far better than the index11. These are all aspects to be thought about when selecting the ideal type of life insurance policy for you.

7702 Iul

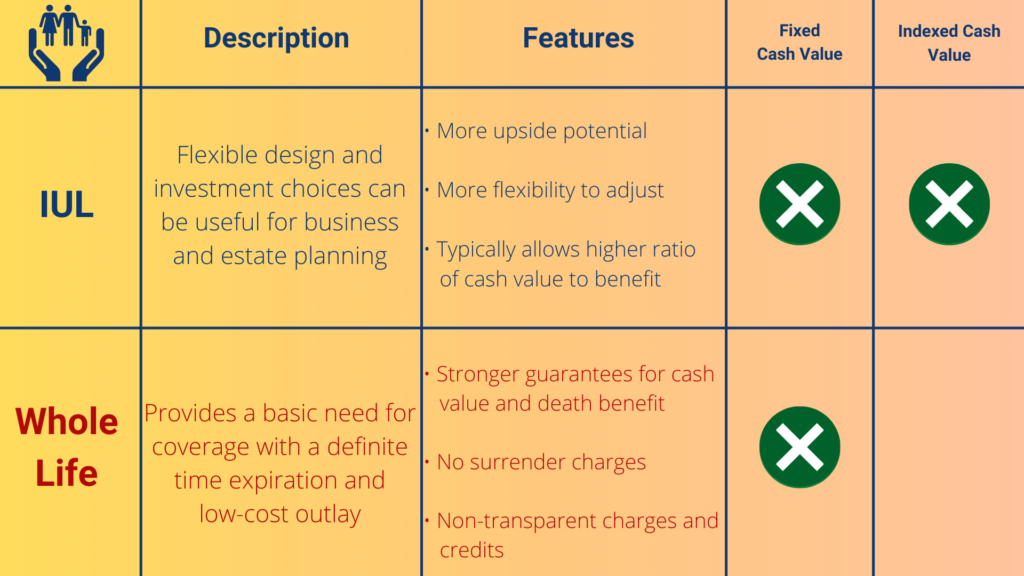

However, because this kind of policy is much more complicated and has a financial investment component, it can frequently include greater costs than various other policies like whole life or term life insurance policy. If you don't believe indexed universal life insurance policy is best for you, here are some choices to take into consideration: Term life insurance policy is a momentary plan that generally uses coverage for 10 to thirty years.

Indexed universal life insurance coverage is a kind of plan that offers extra control and flexibility, along with greater money value development capacity. While we do not use indexed universal life insurance coverage, we can give you with more details about entire and term life insurance policy plans. We advise checking out all your choices and talking with an Aflac representative to uncover the most effective suitable for you and your family members.

The rest is included in the cash money worth of the plan after charges are deducted. The money worth is attributed on a monthly or annual basis with rate of interest based upon rises in an equity index. While IUL insurance policy might verify beneficial to some, it is necessary to comprehend exactly how it works prior to purchasing a plan.

Latest Posts

Equity Indexed Life Insurance Definition

Equity Index Life Insurance

Universal Life Insurance Cash Value Withdrawal